What is Home Equity?

In the most basic terms, home equity is the part of the house you own. Typically when people purchase a home, they do not pay for the entire price. Typically buyers make a down-payment for a percentage of the home’s price, and then take out a loan called a mortgage to cover the rest. “Home Equity” refers to the difference between the value of the house and the amount of the mortgage.

Here is a very basic illustration; we will use the example of a $300,000 house and a 20%, or $60,000 down payment. Using those numbers, you could say this buyer has $60,00 in “home equity” at the time of their purchase.

How Does Maryland Divorce Law Treat Home Equity?

Home equity is just like an other asset in a divorce, but unlike a checking account, home equity can be more difficult to calculate as it doesn’t have as clear value. The home can also play a huge non-financial role in a divorce as well, especially when minor children are involved.

Maryland family law uses the principle of “Equitable Distribution” when determining asset division in a divorce. There are times that means a straight 50/50 split of all marital property, but that is not necessarily always the case.

Will We Have to Sell the House as part of the Divorce?

Every case is unique. If the two spouses are unable to agree on who will keep the house, selling it and splitting the proceeds can be a good solution. There are also cases where one spouse “buys out” the other house, either through a negotiations and giving up other assets, or, more likely, refinancing the house to pull out some of the equity and “pay off” your spouse.

What Role Does Home Equity Play in My Maryland Divorce?

Since the home is typically the most valuable asset that is shared between spouses, home equity can play a huge roll in a divorce, especially when one spouse is planning on keeping the house. The value of the home, amount of the monthly mortgage payment, amount of equity in the home and who plans on keeping the home are all key issues in resolving a divorce.

Why Should a Home Valuation be Part of the Divorce?

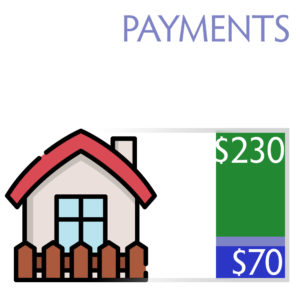

I caution my clients about taking the word of their spouse when it comes to the value of the house. Here are two different scenarios, using the same numbers from above. So we had started with our $300k house and a $60k down payment.

The couple has been making their monthly payments for a few years, so one spouse assumes that they maybe now have $70k in equity, since they have only paid down the principle of the loan by $10,000 . The spouse who is staying in the house offers $40,000 as a buyout to the spouse who is moving out.

The spouse who is leaving the house thinks that since they maybe only entitled to $35,000 (half of the estimated equity) that the $40,000 is a great offer and is inclined to accept.

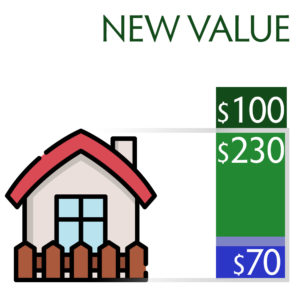

However, after our hypothetical spouse talks with Brandon a little bit about their situation, they request a home valuation that shows the house is now worth $400k (with what home values have been doing in and around Bethesda this type of increase is very likely).

New Value Calulation

Now, in addition to the $70,000 in equity represented by the down-payment and monthly mortgage payments, there is an additional $100,000 in home equity because of the home’s appreciation in value. That means that the spouse who is leaving (assuming its based on a 50/50 split) would be entitled to closer to $85,000 in a payout… making the original $40,000 offer look awful.

Again, obviously these is a hypothetical situation and NOT legal advice. However, it is a reasonable representation of the enormous impact a change in home value can have on a divorce settlement.

To learn more about your specific situation and the best way to move forward, contact Brandon today for a free initial consultation.